Let’s fix cashflow, together.

Our platform comprises class-leading technology backed up with a human service, all for a fee that is fair and fixed.

How Hydr can help your practice

As a trusted advisor to your clients, you will often be the first to notice a problem, and cash flow is one of the most serious that any business can face. Invoice finance – done well – is a powerful instrument to optimise your clients’ cash flow and to save their time when the provider is managing collections.

At Hydr we have gone further: our proprietary software platform enables seamless reconciliation within Xero, bringing you the insight you need to give trusted advice and saving you a great deal of time too!

- 43% of SMEs spend roughly £4.4 billion in administrative costs alone chasing late payments

- 34% of SME business owners who experience late payments rely on overdrafts to help them meet their monthly obligations

- 11% of SMEs struggling with overdue invoices are forced to employ someone to chase up payments

- It is estimated that 68% of SMEs have adopted cloud accounting software, with that number expected to increase over the coming year

Our fees are transparent and fixed

The Hydr difference

Hydr was launched in June ’21 to offer an invoice finance proposition designed specifically for our SME community that is straightforward, digital, transparent and, above all, fair.

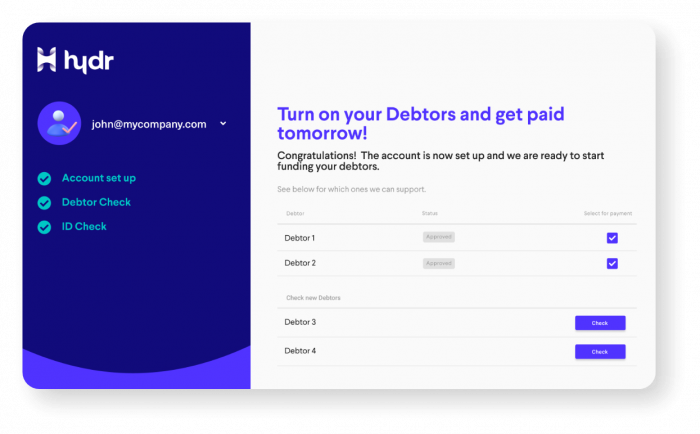

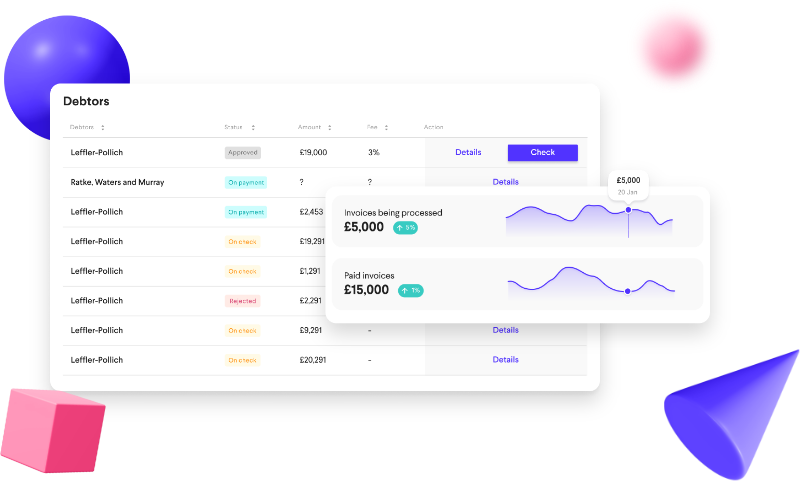

Recognising that whole turnover agreements are not always appropriate on the one hand, and that a client may want more than spot factoring on the other, we have developed Selective Debtor Finance, the proposition that gives your clients the ability to choose the debtors on their ledger they would like funded. Subject to underwriting, that is exactly what we do.

- Fixed means just that – we do not change our fees, even if the debtor is a little late in making payment

- Signup and account management is completely digital (with signup taking around 30 minutes)

- We integrate with Xero, Quickbooks, FreeAgent and Sage Business Cloud

- We are the first to automate reconciliation for clients using Xero (we are also a Connected App)

- We are a disclosed product, managing credit control of the funded debtors on your clients’ behalf

- We fund 100% of the value of invoices for fees that are fixed and fairly priced

- We do not take a charge or directors’ guarantee

- The customer receives the balance of the invoice value minus our fixed fee in as little as 24 hours from raising it

Automated reconciliation with Xero

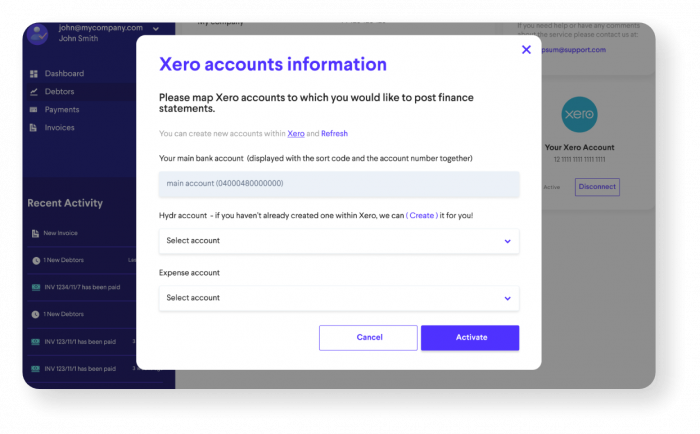

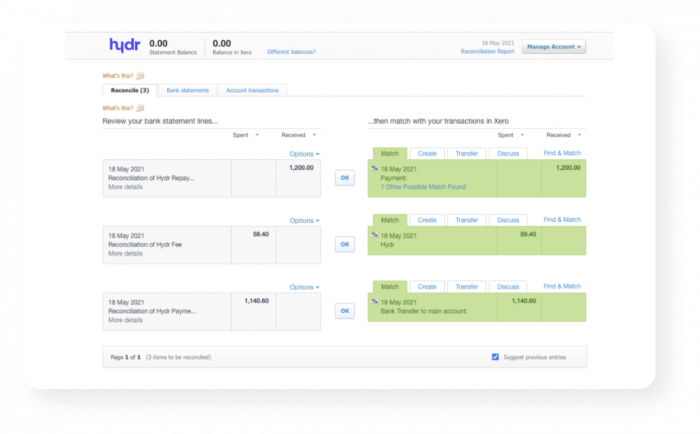

Reconciling invoices funded by Hydr with your cloud accounting software Hydr has pioneered the capability to automatically reconcile your Xero account when Hydr pays the invoice to you (minus our fixed fee). Hydr also has the ability to enable you to post the fee to a chosen expense account.

Class-leading, seamless integration

Although we are now compatible with the major cloud accounting software packages on the market, our relationship with Xero accounting software, the global small business platform, is one of our most valued partnerships. Our platform was developed with Xero, and Xero was our launch partner. By linking your accounting software to the Hydr platform, we can fund your clients invoices in as little as 24 hours. Not only that, but we have built a class-leading, seamless integration from the moment you raise an invoice to reconciliation..

Reconciling invoices funded by Hydr with your cloud accounting software

Hydr has developed the capability to record within your cloud accounting software when Hydr funds an invoice, to post the Hydr fee into a chosen expense account and to reconcile once Hydr is paid the value of the invoice by your funded debtor.

We are currently able to do this for customers using Xero – we are working to develop the same functionality for our other software partners.

In order to activate automated reconciliation, follow the following steps:

Signing up takes minutes, is completely free and secure: take back control of your cashflow!

We take pride in what our customers think

Hydr + Xero: There from the start

We could not have wished for a better launch partner than Xero. Once you have connected your Xero account to the Hydr platform, simply continue raising your invoices through Xero and we’ll pick them up and pay them within 24 hours.

We go further and deeper in our Xero integration – not only will we pick up invoices of your chosen customers without you having to enter the data onto our platform, but reconciliation is seamless as well, making sure you are always aware of what has been funded, paid and when.

Xero is world-leading online accounting software built for small business.

- Get a real-time view of your cashflow. Log in anytime, anywhere on your Mac, PC, tablet or phone to get a real-time view of your cash flow. It’s small business accounting software that’s simple, smart and occasionally magical

- Run your business on the go. Use our mobile app to reconcile, send invoices, or create expense claims – from anywhere

- Get paid faster with online invoicing. Send online invoices to your customers – and get updated when they’re opened

- Reconcile in seconds. Xero imports and categorises your latest bank transactions. Just click ok to reconcile.

By clicking the “Create Account!” button you’ll start the sign-up process. This is in four steps and takes around 15 minutes, but, we’ll tell you in around 2 minutes the debtors that can be funded and – critically – the fees we will charge! In order to complete it in one sitting, you will need your Xero account details, either a current driver’s licence or passport and the details of your company bank account. If you don’t have all of this to hand, no problem: when you log back on to complete onboarding, we’ll take you back to where you left off.

Related articles

What would you do if your payment terms were tomorrow?